LoanMaster Loan Calculator

The loan calculator is used to perform loan calculations. It

is used to calculate finance charges, payments, maturity dates, balloon

payments, and Reg Z APRs for new loans. It is optimized for calculating and

creating new loans and adding them to the system.

It does NOT currently calculate APR on balloon payment

loans.

It is not a typical business calculator with the five time

value of money keys, PV, N, I, PMT, FV and is not intended to replace that

type calculator

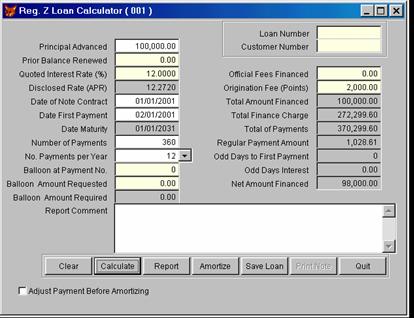

The loan calculator screen looks like this:

y

y

Calculating a Loan

This screen shows the entries and results for example 1 in

the examples at the bottom of this section.

As in all the other screens, White fields are mandatory.

yellow fields are optional, and grey fields cannot be entered, they are

reserved for output.

To calculate the above loan, start at the top left and enter

the data you see in the white and yellow fields

Always start at the top left and work down that column. In

this case you continue at the top right and enter the origination fees. Click

the Calculate button when you are ready to see the results. You can change any

of the input fields as often as you like and recalculate by clicking the

Calculate button again.

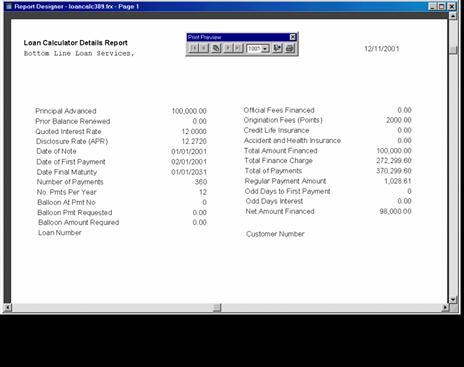

The results will appear in the grey fields. A printed report

is available by clicking on the Report button. The report for the above loan

looks like this:

Loan Calculator Report

Entering Loan Data to the Calculator

Principal Advanced

This is the amount of cash actually advanced to the

borrower. If you are doing a multiple advance loan, the calculator will not

produce meaningful results since it doesn’t know about the future advances.

Prior Balance Renewed

If part or all the proceeds of this new loan will be used to

payoff a prior loan, you can record this fact here. The Principal Advanced and

Prior Balance Renewed will be added together to calculate the face amount of

the loan, the amount that will be used to calculate the payment amount and

finance charge

If you don’t care about recording that part of the proceeds

were used to pay off another loan, you can omit this field and enter the total

payoff of the old loan plus the cash advanced in the Principal Advanced Field.

This amount is recorded ONLY on the calculator report. It is

not stored in the loan database.

Quoted Interest Rate (%)

Enter the stated rate to be charged on the loan, the accrual

rate. This is the rate that will be used to calculate interest on the loan. It

the rate that will be stated in the loan document, not the APR rate from the

disclosure statement. ( Some contracts print both the accrual rate and the APR

disclosure on the same page.) This rate is entered as a percent. Ten percent is

entered 10.00. Three hundred and seventy one and one half percent is entered

371.50.

Disclosed Rate (APR)

This is the disclosure rate for the disclosure statement.

You cannot enter this field. It is calculated by the program. If it looks

wrong, you may have entered something other than you intended. Eg. $100

origination fee instead of $10 origination fee.

Date Note Contract

This is the date of the note. Normally it is the later of

the date on which the document was signed or the date the funds were advanced.

It is the date on which interest will begin to accrue. If this date is

03/15/01, the program will charge the borrower one day interest during the

update of 03/16/01.

Date Loan Maturity

This is the date on which the final payment is due. This

date is calculated. You cannot enter it or change it.

Number of Loan Payments

This is the number of payments in the amortization period.

This number may be larger than the actual life of the loan. You can enter 360

payments here with 12 payments per year. Then enter 120 in the Balloon at

Payment Number field. The result will be a loan that matures in 10 years but

with payments “as if” it were a 30 year loan. This will obviously result in a

very large balloon payment.

Number of Payments Per Year

This is the payment frequency. How many regularly scheduled

payments are required by the loan document repayment terms? The calculator

assumes 12 but other options are available.

Balloon at Payment Number

Use this field to cause the loan to balloon. The loan will

balloon, all interest and principal and other charges will be come due on the

date of this payment. Entries in this field must be less than the Number of

Payments to be meaningful.

Balloon Amount Requested

This is a dollar amount. You can state a dollar amount for

the balloon payment. If you use this field, the calculator will calculate the

payment amount payment required to result in a balloon payment as close as

possible to the requested amount. The balloon payment will not be exactly equal

to the amount entered here because the payment amount required will have some

fraction of a cent but real payments must be stated in exact cents.

Balloon Amount Required

This is the amount of balloon payment actually required. It

is calculated. You cannot enter it or change it.

Report Comments

This is a Windows edit box. You can enter text here and it

will be printed on the loan report. It will not be stored in the database.

Loan Number

This is not required for calculations. If you intend to add

the loan to the loan system or to print an amortization schedule, you must

provide a valid, unique loan number. If you enter a loan number and decide

later not to save the loan. The loan number is not added to the loan system and

can be sued again later.

Customer Number

This is not required for calculations. If you intend to add

the loan to the loan system, you must provide a valid, customer number. It

does not need to be unique. One customer number can be used on many loans. The

customer record is required to exist prior to adding the loan to the database.

The customer number not required to print an amortization

schedule.

Official Fees Financed

This is fees paid to government or other agencies, usually

for recording lien information. It is added to the amount financed but is not

part of the finance charge and is not considered finance charge in the APR

calculation. It does not include any type of origination fee. The general rule

here is: If you pay it to a third party, it belongs here. If you keep it, it

belongs in Origination Fees. Examples include: Recording fees, credit report

fees, title application fees, etc.

Origination Fees (Points)

There are many names for this type fee. This is any fee the

lender charges, and keeps, as a condition of extending the credit. It is not

added to the amount financed but is part of the finance charge and is included

as finance charge in the APR calculation. Examples include: origination fees,

points, setup charge, setup fee, documentation fee, application fees, document

preparation fees.

Total Amount Financed

This is the total of all the amounts financed. It is the

original principal amount of the loan. It includes Principal Advanced, Prior

Balance Renewed, Official Fees Financed. It does not include Origination Fees or

Finance Charges.

If you are trying to manually check the loan APR calculations,

note that this is NOT the principal amount used in the APR calculations. The

APR is calculated on the net Amount Financed.

Net amount financed is calculated. You cannot enter it or change it.

Total Finance Charge

This is the total dollar cost of the loan. It includes all

the finance charges, Interest and Origination Fees.

It is calculated like this:

Total

Finance Charge = (No Payments * Payment Amount) - Net amount Financed

Net Amount Financed = Total Amount

Financed - Origination Fees.

Net amount financed is calculated. You cannot enter it or change it.

Total of Payments

This is the total amount of all payments scheduled to repay

the loan. This is like the amortization schedule in that it is an idealized (

estimated ) amount and assumes that every single payment will be paid on

exactly the date it is due.

Total of payments is calculated. You cannot enter it or change it.

Regular Payment Amount

This is the amount required to amortize the Total Amount

Financed over the life of the loan. You can check it with a business calculator

for simple loans but not for loans with balloons or odd days. It is calculated

on the Total Amount Financed using the Quoted Rate (not the APR).

The regular payment amount is calculated. You cannot enter it or change it.

Odd Days to First Payment

Normal loan calculations assume the first payment is made

exactly one month after the date of the note. This is not always the case. When

this is not the case, the Number of Odd Days is the number of days greater or

less than one exact month to the date of the first payment. This number may be

positive or negative. Negative indicates an early payment. Positive indicates a

late payment.

Odd days is calculated. You cannot enter it or change it.

Odd Days Interest

This is the amount interest on the total amount financed, at

the Quoted Rate, for the number of Odd Days. It will be negative it the first

payment is early. It is included in the finance charge.

Odd days interest is calculated. You cannot enter it or change it.

Net Amount Financed

The net amount financed is the amount the borrower has

available for his own use, the amount he can actually spend. When origination

fees are charged, they are deducted from the face amount of the loan and the

borrower actually receives less than the face amount of the loan. Net Amount Financed

is calculated like this:

Net Amount Financed = Total Amount Financed - Origination

Fees.

Net amount financed is calculated. You cannot enter it or change it.

Adjust Payment Before Amortizing

Some lenders make a practice of rounding up payments to the

nearest dollar. If the calculated payment amount is 335.47, the lender will

round it up to 336.00. This is not really an over charge, since the final

payment will be somewhat less. It does however do violence to the APR

calculations.

If you round up your payments, and if you want to print an

amortization schedule, check this box before you click Amortize. You will be

allowed to change the payment amount before printing the amortization schedule.

If you round payments up, the APR calculation will not be

correct. For this reason, even if you round up and print the amortization

schedule, the rounded up payment amount will not be saved.

If you save a loan to the database after rounding up the

payment amount. The saved versino will reverto to the originally calculated

payment amount.

Loan Calculator Buttons

| Button |

Action |

| Clear |

Clear all fields and reset the

dates to the defaults |

| Calculate |

Calculate the results for the current

inputs |

| Report |

Print the calculator report |

| Amortize |

Print an amortization schedule |

| Save Loan |

Save this loan to the loan system

database. |

| Print Note |

Print the loan

contract. (If available - User supplied ) |

| Quit

|

Exit the calculator |

Loan APR Examples

10,000.00 Repaid in 12 Payments

|

|

1

Regular

Payment

|

2

Late

Payment

|

3

Early Payment

|

|

|

|

|

|

|

|

|

|

|

Date Note

|

01/01/2001

|

01/01/2001

|

01/01/2001

|

|

|

|

Date First

|

02/01/2001

|

02/10/2001

|

01/20/2001

|

|

|

|

Odd Days

|

0

|

9

|

19

|

|

|

|

Amount

|

10000

|

10000

|

10000

|

|

|

|

Quoted Rate

|

12

|

12

|

12

|

|

|

|

Odd Days Interest

|

0

|

30

|

-36.67

|

|

|

|

Number of Payments

|

360

|

360

|

360

|

|

|

|

Payment

Amount

|

888.49

|

891.16

|

885.23

|

|

|

|

Finance

Charge

|

661.88

|

693.92

|

622.76

|

|

|

|

Disclosed APR

|

12.0004

|

12.0013

|

11.9926

|

|

|

|

REG-Z

Disclosed APR

|

12.0005

|

12.0014

|

11.9926

|

|

|

100,000 Repaid in 360 Payments

|

|

4

Regular

Payment

|

5

Late

Payment

|

6

Early Payment

|

|

|

|

Date Note

|

01/01/2001

|

01/01/2001

|

01/01/2001

|

|

|

|

Date First

|

02/01/2001

|

02/10/2001

|

01/20/2001

|

|

|

|

Odd Days

|

0

|

9

|

19

|

|

|

|

Amount

|

100,000

|

100,000

|

100,000

|

|

|

|

Origination

Fee

|

2000

|

2000

|

2000

|

|

|

|

NET Amount Financed

|

98,000

|

98,000

|

98,000

|

|

|

|

Quoted Rate

|

12

|

12

|

12

|

|

|

|

Odd Days Interest

|

0.00

|

300.00

|

-366.67

|

|

|

|

Number of Payments

|

12

|

12

|

12

|

|

|

|

Payment

Amount

|

1028.61

|

1031.70

|

1024.84

|

|

|

|

Finance

Charge

|

272,299.60

|

273,412.00

|

270,942.40

|

|

|

|

Disclosed APR

|

12.2720

|

12.2712

|

12.2727

|

|

|

|

REG-Z

Disclosed APR

|

12.2721

|

12.2712

|

12.2727

|

|

|

Small Dollar, Large APR

|

|

7

Regular

Payment

|

8

Late

Payment

|

9

Early Payment

|

|

|

|

Date Note

|

01/01/2001

|

01/01/2001

|

01/01/2001

|

|

|

|

Date First

|

02/01/2001

|

02/10/2001

|

01/20/2001

|

|

|

|

Odd Days

|

0

|

9

|

19

|

|

|

|

Amount

|

500

|

500

|

500

|

|

|

|

Origination

Fee

|

25

|

25

|

25

|

|

|

|

NET Amount Financed

|

475

|

475

|

475

|

|

|

|

Quoted Rate

|

360

|

360

|

360

|

|

|

|

Odd Days Interest

|

0.00

|

45.00

|

-55.00

|

|

|

|

Number of Payments

|

12

|

12

|

12

|

|

|

|

Payment

Amount

|

156.73

|

170.84

|

139.49

|

|

|

|

Finance

Charge

|

1405.76

|

1575.08

|

1198.88

|

|

|

|

Disclosed APR

|

381.5323

|

379.6228

|

370.4848

|

|

|

|

REG-Z

Disclosed APR

|

381.5323

|

379.6229

|

370.4849

|

|

|

Other Payment Frequencies

|

|

10

Monthly

|

11

Quarterly

|

12

Annual

|

13

Bi-Weekly

|

14

Weekly

|

|

Date

Note

|

01/01/2001

|

01/01/2001

|

01/01/2001

|

01/01/2001

|

01/01/2001

|

|

Date

First

|

02/01/2001

|

04/01/2001

|

01/01/2002

|

01/15/2001

|

01/08/2001

|

|

Odd

Days

|

0

|

0

|

0

|

0

|

0

|

|

Amount

|

10000

|

10000

|

10000

|

10000

|

10000

|

|

Origination

Fee

|

100

|

100

|

100

|

100

|

100

|

|

NET

Amount Financed

|

9900

|

9900

|

9900

|

9900

|

9900

|

|

Quoted

Rate

|

14.00

|

14.00

|

12.00

|

18.00

|

18.00

|

|

Odd

Days Interest

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

|

Number

of Payments

|

36

|

36

|

10

|

72

|

104

|

|

Payment

Amount

|

341.78

|

492.84

|

1769.84

|

176.84

|

114.66

|

|

Finance

Charge

|

2404.08

|

7842.24

|

7798.40

|

2832.48

|

2024.64

|

|

Disclosed

APR

|

14.7094

|

14.2802

|

12.2462

|

18.7869

|

19.0616

|

|

REG-Z

Disclosed

APR

|

14.7095

|

14.2803

|

12.2462

|

18.7869

|

19.0617

|